High debt, Higher Interest and Lower buying power for some, beginning in Q3, 2023.

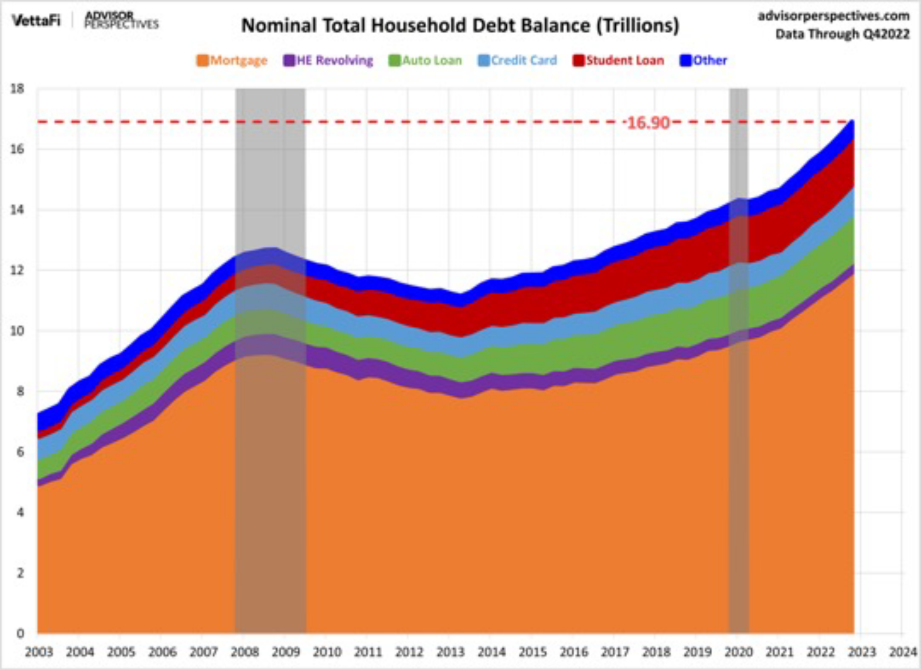

Credit cards account for almost 2/3 of all purchases made in the US. As inflation and debt march higher, the buying power linked to those cards lies at the crossroads of tighter credit and higher prices. Why is this happening? We’re glad you asked! US consumer debt is at an all-time high as shown below, surging by $2.3 trillion in new debt since the Covid-19 outbreak. When you consider the additional credit liquidity (around $5 trillion) the government pumped into the economy on top of that, it is clear why Inflation is high: $7.3 trillion in borrowed money buying power. While those pesky supply chain issues bear some of the blame, credit usage gone wild does as well. Put in laymen’s terms: inflation may have started with inventory shortages but has been sustained and enhanced by our “buy now, pay later” culture. Most economists agree that credit empowered spending by US consumers is the primary reason our GDP remains slightly positive. But if the Fed is in the process of raising rates, which by design will squeeze credit and choke liquidity, can that continue? As rates rise and credit tightens, how much of that US consumer resiliency will be affected? That is the question we need to know, now!

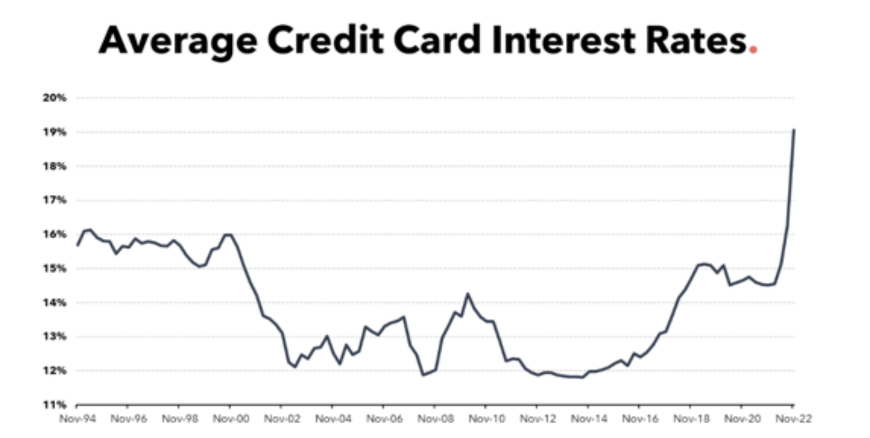

What is clear is that both the US consumer and the US government are paying higher rates on record high debt balances which spells spending will S-L-O-W-D-O-W-N! So, what does that mean for your brand? It depends on who your brand serves as it’s clear that the financial “haves and the have nots” are affected differently in phases where liquidity shrinks. One thing is clear: if your core customers are living on credit, their ability to consume is shrinking quickly as rates are rising steeply as shown in the chart below.

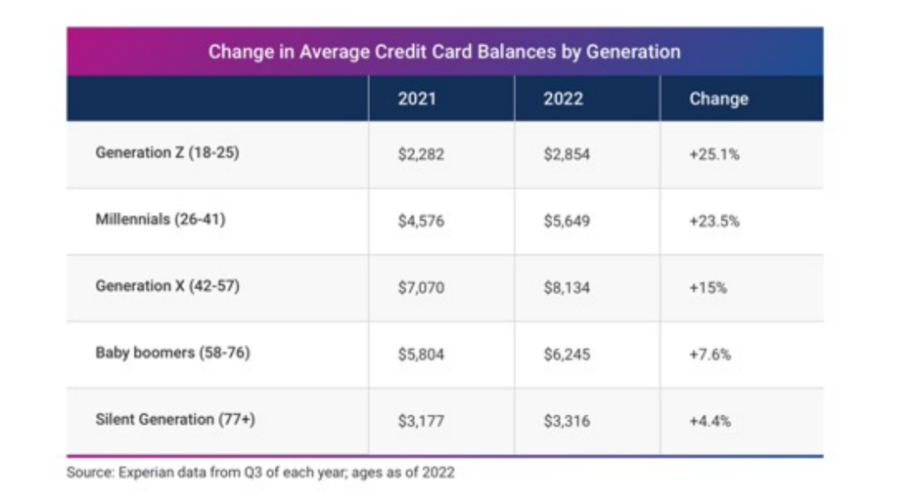

As rates rise and all other variables are held constant, capacity to buy shrinks. Marketers should analyze their own customer base to understand which segments will be the most effected as credit tightens. As inflation rose in 2022, younger Americans turned to credit for day-to-day purchases, and many are beginning to reach the upper limits of credit availability. Americans under the age of 41 increased credit balances at a nearly 25% clip while real wages grew around 5%. See graph below:

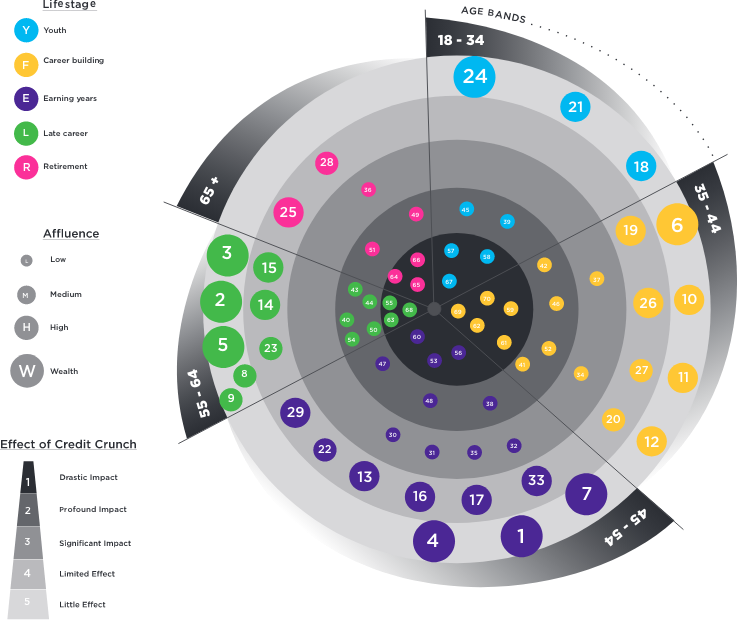

The bottom line is younger, lower wage earners are facing higher rates and a reduction in additional credit availability. Brands deriving significant revenues from these lifestages should create plans to track and replace revenue loss, beginning in the second half of 2023. But how can you do that tactically? We believe it’s critical to map this into your own brands planning using segmentation systems, like the example below using Personicx:

SUMMATION

As you prepare for the second half of 2023, an inside out analysis of your core profit segments is a logical and prudent first step to accurate forecasting of growth for your brand. While there is a high degree of economic uncertainty ahead, we believe planning can equip your brand with a plan to grow during that timeframe.

Stop guessing and start Knowing with blu.

In an ever changing marketing landscape, one thing remains paramount: being able to identify customers is the most basic requirement for direct marketing. Customer-obsessed marketers need to leverage the power of online identity resolution starting now. Marketing spend needs to be stewarded at the highest levels, because not knowing who you are marketing to is no longer an option.

It’s time to stop guessing and start KNOWING.

At blu, we give marketers the power to find (and get to know) the right people in the right places at the right times. We provide the vision and insight you need to identify your best customers; to target the people most likely to be impacted; and then focus on the best ways to be seen, heard, and understood by the people who matter most — YOUR CUSTOMERS.

Chad Stubbs

Chief Innovator | Reflex Blu

Driven by a passion to connect people with innovation and excellence, Chad Stubbs launched Reflex Blu in 1999. His “creatalytical” vision of leveraging creative and analytic excellence is at the heart of blu’s continuously innovative culture. Chad has been the strategic lead on countless brands over the past 20 years, and he still gets a thrill out of building profitable customer journeys for the brands we serve at blu.